Best No Annual Fee Credit Cards in India

While many premium credit cards charge an annual fee, there are a variety of credit cards that offer ample rewards without an annual fee. If you decide you want to apply for a credit card with no annual fee, you really can’t go wrong with any of CreditHita’s favorite ₹0 annual fee credit card suggestions. Find low rates, cashback, and rewards with the best no annual fee cards.

- Get 6 points on Dining, Hotels & Telecom

- Get 2 points on others

- ₹2000 Cleartrip voucher

- ₹250 Swiggy Voucher

- Get 10% cashback for the first 90 days.

- No Joining and Annual Fees

- 10% Cashback up to ₹2,000 in the first 90 days of issuance

- Get a movie ticket voucher worth ₹500 on spending over ₹50,000 in a calendar month. Maximum of ₹3000 per cardholder in a year

- BookMyShow Saturday Buy one get one free movie tickets Up to ₹250

- 2 Reward points for every ₹150 spent

- 3X Rewards on Dining, Hotels, and Telecom for the first 12 months from the date of issuance

- 5 Times (5X) Rewards on subsequent purchases made upon spending ₹400,000 in a year, up to ₹1,000,000.

- Fuel Surcharge Waiver

- Redeem Air Miles on Jet Airways and Singapore Airlines

- Discounts on Movies, Flights, Restaurants and more

- Get 6 points on Online, Dining & Telecom

- Get 1 point on others

- No Joining Fee. Annual fee of ₹499 (Waived off on annual spends of ₹50000 or more). Amazon voucher worth ₹500 on payment of the annual fee.

- 10% Cashback up to ₹1000 in the first 60 days of issuance

- 3X Rewards on Online, Dining & Telecom spends

- Attractive Instalment plans at 10.99% per annum for EMI products booked within the first 90 days of card issuance

- Get a movie ticket voucher worth ₹200 on spending over ₹15,000 in a calendar month. Maximum of ₹1200 per cardholder in a year

- Fuel Surcharge Waiver

- 2 Reward points for every ₹100 spent

- Movie ticket voucher worth ₹1,000 on spending over ₹75,000 in a calendar month. Maximum of ₹6,000 per cardholder in a year

- 50% cashback at PVR Cinemas on purchase of movie tickets, upto ₹500 cashback per month

- 2 Reward points for every ₹100 spent

- No Joining and Annual Fees

- Movie ticket voucher worth ₹1,000 on spending over ₹75,000 in a calendar month. Maximum of ₹6,000 per cardholder in a year

- 50% cashback at PVR Cinemas on purchase of movie tickets, upto ₹500 cashback per month

- Fuel surcharge waiver

- Online fraud protection and lost card liability

- Air miles conversion on InterMiles, British Airways and Singapore Airlines

- Discounted green fees and dedicated 24-hour golf concierge service

- Airport lounge access

- Get 4 points online

- Get 2 points on others

- 2 Reward Points on ₹150 spent. 2 X Reward Points on online spends.

- Redeem Reward points as CashBack on your MoneyBack Credit Card (100 Reward Points = ₹20)

- Zero Lost Card liability post reporting of the loss of card

- Do minimum 4 transactions using a Credit card every month and get

- Free Accidental Death Insurance up to ₹50 Lakhs*

- Free Fire and Burglary protection for goods above ₹5000 for 180 days

- Spend Milestone Offer

- Spend ₹50,000 in a Quarter and get ₹500 E-Voucher

- Earn 5X Reward Points on CSD, Dining, Movies, Departmental Stores and Grocery Spends

- Avail waiver of Renewal Fee on annual spends of Rs. 50,000 or more

- 1% Fuel Surcharge Waiver at all fuel stations across the country

- Earn 5X Reward Points on CSD, Dining, Movies, Departmental Stores and Grocery Spends

- No Joining and Annual Fees

- Earn 5X Reward Points on CSD, Dining, Movies, Departmental Stores and Grocery Spends

- Avail waiver of Renewal Fee on annual spends of ₹50,000 or more

- 1% Fuel Surcharge Waiver at all fuel stations across the country

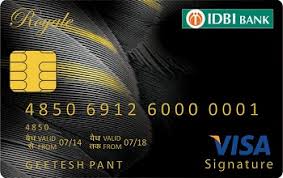

- 3 Delight points for every ₹100 spent

- Welcome bonus 750* Delight points

- Complimentary Visa Airport Lounge Access

- Joining Fee - ₹0

- Earn 3 Delight points for every ₹100 spent

- Additionally you will earn a welcome gift of 750 Delight Points on first usage of the card within 30 days days or 400 Delight Points on usage between 31 to 90 days from the card issuance date. The minimum eligible transaction value for the welcome gift is 1,500.

- Enjoy interest free credit of up to 48 days* on your purchases and manage your payments as per your convenience

- Waiver of 1%* fuel surcharge every time you fill fuel using IDBI Bank Royale Signature Card across all fuel stations for transactions in the range of 400 to 5000

- Air Travel Accident Insurance Cover for a value of 25 lakhs is provided.

- Complimentary Visa Airport Lounge Access.

- Zero Lost Card Liability is offered in case of theft or loss of card.

- 7% on Ola rides

- 5% on all flight bookings via Cleartrip

- Earn 1% Reward Points on all other spends

- 20% back on 6k+ restaurants on payment via Dineout.

- 1% Fuel Surcharge Waiver at fuel stations across the country.

- 7% on Ola rides (upto ₹500 a month)

- 5% on all flight bookings via Cleartrip (upto ₹5,000 domestic, ₹10,000 intl)

- 20% on all domestic hotel bookings via Cleartrip

- 20% back on 6k+ restaurants on payment via Dineout.

- 6% cashback on international hotels booked via Cleartrip

- 12% cashback on Activities booked via Cleartrip

- Earn 1% Reward Points on all other spends

- 1 Reward Point = ₹1

- Zero Annual Fee for the first year

- Second year onwards, Renewal fee of ₹499 reversed on annual spends of ₹1 Lakh

- Earn 5% back on Amazon.in for Amazon Prime customers

- Earn 3% back on Amazon.in for non-prime customers

- Earn 2% back on 100+ Amazon Pay partner merchants

- Earn 1% back on all other payments

- Save a minimum of 15% on your dining bill at participating restaurants

- 1% Fuel Surcharge Waiver at fuel stations across the country.

- Earn 5% back on Amazon.in for Amazon Prime customers

- Earn 3% back on Amazon.in for non-prime customers

- Earn 2% back on 100+ Amazon Pay partner merchants

- Earn 1% back on all other payments

- No limit to the earnings from this card

- No expiry date for your earnings

- Save a minimum of 15% on your dining bill at participating restaurants

- Get 1.5% cashback on all online spends (excluding transfer of funds to online wallet)

- Get 1% on others

- ₹500 Amazon voucher

- 20% off on Swiggy orders above ₹400, Discount up to ₹100, valid once per month

- 5% discount on Amazon spends of ₹1,000 or above, Maximum discount of ₹250 per month.

- Buy-one-get-one-free movie tickets on Saturdays up to ₹250.

- Get 1.5% cashback on all online spends (excluding transfer of funds to online wallet)

- Get 1% on others

- ₹500 Amazon voucher

- 20% off on Swiggy orders above ₹400, Discount up to ₹100, valid once per month

- 5% discount on Amazon spends of ₹1,000 or above, Maximum discount of ₹250 per month.

- Buy-one-get-one-free movie tickets on Saturdays up to ₹250.

- Unlimited cashback on all your transactions

- Second year onwards fee ₹750 will be waived off if you spend more than ₹100,000 in the previous year

- Up to a 15% discount at over 1,000 restaurants across major cities

- Convenient EMI options that allow you to pay your credit card dues in Equated Monthly Installments (EMIs) such as Balance Transfer on EMI, Cash-on-EMI, Loan-on-Phone etc.

- his card is enabled with VISA Paywave technology that allows contactless payments on your credit card.

- 2 Reward points for every ₹150 spent

- Movie ticket voucher worth ₹500 on spending over ₹50,000 in a calendar month. Maximum of ₹3,000 per cardholder in a year

- Get ₹2,000 Cleartrip voucher on first transaction

- 2 Reward points for every ₹150 spent

- Get ₹2,000 Cleartrip voucher on first transaction

- No Joining and Annual Fees

- Movie ticket voucher worth ₹500 on spending over ₹50,000 in a calendar month. Maximum of ₹3,000 per cardholder in a year

- Get 2 Airport Lounge Access to Domestic and International lounges

- 5X Rewards on subsequent purchases made after crossing spend amount of ₹400,000 in an anniversary year up to a maximum 15,000 accelerated reward points.

- Up to 15% off at over 1000 restaurants in major cities.

- Fuel Surcharge waiver at any fuel pump across India for transactions between ₹400 & ₹4,000 subject to a maximum amount of ₹250 per calendar month

HSBC Visa Platinum Credit Card

Rewards Rate

For every ₹150 you spend

SignUp Bonus

Fee

₹0

Exclusive Privileges

Get a BookMyShow voucher worth ₹500 on spending over ₹50,000 in a calendar month.

Card Brand

Card Details

HSBC Smart Value Credit Card

Rewards Rate

For every ₹100 you spend

SignUp Bonus

₹2000 Cleartrip voucher; ₹250 Amazon voucher; ₹250 Swiggy Voucher; Get 10% cashback for first 60 days; Get ₹200 BookMyShow voucher; Gaana+ subscription for 3 months.

Fee

₹0

Exclusive Privileges

Get a BookMyShow voucher worth ₹200 on spending over ₹15,000 in a calendar month.

Card Brand

Card Details

HSBC Premier Mastercard Credit Card

Rewards Rate

Milestone Offer

Fee

₹0

Movie Offer

Card Brand

Card Details

HDFC Bank MoneyBack Card

Rewards Rate

- For every ₹150 you spend

Milestone Offer

Get ₹500 e-Voucher on spending ₹50,000 in a Quarter

Fee

₹0

Fuel Surcharge waiver

1% Fuel Surcharge waived off on fuel transactions.

Card Brand

Card Details

Shaurya SBI Card

Rewards Rate

Renewal Fee

Fee

₹0

Benefit

Card Brand

Card Details

IDBI Bank Royale Signature Credit Card

Rewards Rate

SignUp Bonus

Fee

₹0

Airport Lounge Access

Card Brand

Card Details

SBI Ola Money Credit Card

Rewards Rate

Benefits

Fee

₹0

Fuel Surcharge waiver

Card Brand

Card Details

Amazon Pay ICICI Credit Card

Rewards Rate

Benefits

Fee

₹0

Fuel Surcharge waiver

Card Brand

Card Details

HSBC Cashback Credit Card

Rewards Rate

SignUp Bonus

Fee

₹0

Movie Offer

Card Brand

Card Details

HSBC Advance Visa Platinum Credit Card

Rewards Rate

Milestone Offer

Fee

₹0

SignUp Bonus

Card Brand

Card Details

WHAT DOES NO ANNUAL FEE MEAN?

Let’s first understand the annual fee on a credit card. The annual fee is the amount you are asked to pay when you hold the card and enjoy the benefits offered by the card issuer. This annual fee is like a membership fee you pay when you use your Gym or Resort. For the time you use the facility and enjoy the benefits you pay a membership fee, similarly, issuers charge annual fees to their customers. The main reason an issuer charges an annual fee is to provide exclusive benefits to its cardholders.As now you understand annual fees on credit cards and why issuers charge fees for using their credit cards, the next question is to find if there are any credit cards that are free to hold and use. To use a credit card with no annual fee, you won’t have to worry about budgeting the annual fee. Also is it easy if you choose the right card to recoup the amount you pay for the yearly fee of a credit card. While there are always free to use cards, some issuers offer certain cards free for the first year and charge you for the subsequent years. On some credit cards your yearly renewal fee is waived if you spend a certain amount during the calendar year.

No annual fee doesn’t mean that these credit cards do not provide any benefits, they offer decent benefits and are recommended for first-time users, and for the purposes of building your credit history. Sometimes you can enjoy up to 1.5 to 2 times more benefits when you pay a nominal affordable annual fee.

ARE THERE DIFFERENT KINDS OF NO ANNUAL FEE CREDIT CARDS?

There are many credit cards that do not charge an annual fee and offer benefits in a specific category, so based on your spending habits you can get a travel card with no-annual-fee or a shopping card with no-annual-fee. Here is a list of credit cards that are free to hold and use.Cash-back credit cards: The SBI Ola Money Credit Card provides a solid 7% cashback rewards on Ola rides with no annual fee and charges a fee from the second year onwards, and the renewal fee can be waived if you spend ₹1 Lakh in any calendar year. This card offers a very good burn rate, paying ₹1 for every reward point.

Travel credit cards: HSBC Visa Platinum Credit Card gives 6 points on hotel stays for every ₹150 you spend. One unique benefit this card offers every new cardholder is 10% cashback for the first 90 days. In addition to being a very good travel card, HSBC Visa Platinum credit card offers a BookMyShow voucher worth ₹500 on spending over ₹50,000 in a calendar month. The accumulated reward points on this travel card can be redeemed as Singapore Airlines Air Miles using which you can buy your future tickets or upgrade your travel class.

Reward credit cards: Amazon Pay ICICI Credit Card gives 3% cashback for anyone on their purchases on the Amazon.in website. Exclusively for Amazon Prime customers this card offers an additional 2% more cashback making a total of whooping 5% cash back rewards on your online shopping giving you a 5% discount on every product you buy. One caveat is that this credit card is not for everyone and by invitation only. There is no cap, upper limit on the rewards earned from this card with no expiry date on your accumulated earnings.

Fuel credit cards: HDFC Bank MoneyBack Card gives 4 points for every ₹150 you spend online and 1% surcharge waived off on fuel transactions. There is no annual fee for the first year and the HDFC charges a ₹500 fee from the second year onwards. The burn rate for these points is you get ₹20 when you redeem every 100 points.

Based on your spending habits and specific needs, it is a good idea to do research about no-annual-fee cards in the required specific category. Spending time on research to find the right card is worth it as some credit cards offer amazing rewards rates, very good welcome bonuses, and perks. Always do the math.

DOES PAYING AN ANNUAL FEE ON A CREDIT CARD EVER WORTH IT?

As you know that every coin has two sides, the answer to this question can vary depending on which side you are looking from. Annual fee cards aren’t for everyone, but sometimes it can be double the worth to pay and own a card. Based on your needs choose two credit cards, one free card, and one that has an annual fee in the same category and do the math yourself to find if paying an annual fee is worth it. By evaluating these two cards on earn rate and burn rate based on your monthly spending you can pick the right side of the coin. For example if no-annual-fee rewards you ₹5,000 for your spendings in a year and the second card with an annual fee offers you ₹10,000 (including welcome bonus and higher reward rates) and if you have to pay a joining fee of ₹1,000. Paying annual fees is still worth it as you are getting 80% higher returns (₹4,000 more) than the no-annual card.HOW TO BUILD A CREDIT SCORE USING A CREDIT CARD?

Building credit score is essential not only to have higher approval odds for your financial needs but also provides larger benefits and rewards. There are several ways to build credit score but creating credit history using a credit card is the easiest and if you are starting and don't have credit history then there are three main ways you can apply for credit cardsi) Secured credit card

If you don’t have any credit history it’s very hard to get approval for the credit card without a credit score. so banks offer a better way to build credit by applying for a secured credit card. A secured credit card is usually tied to your savings account, and you are expected to open a fixed deposit account and deposit an amount. Once you deposit a certain amount then banks approve a credit card with a credit limit based on the amount you deposited. The amount deposited is just used as a security deposit by banks, and you will use a secure credit card like any other credit card and pay the dues.

ii) Open a joint account

If you don’t have a good credit score and trouble getting a credit card then the other option is to open a joint account with someone who has a good credit score. After the card is approved it’s your responsibility to pay your bills and maintain a healthy credit history. If you miss any payments then not only whoever cosigned your application is responsible to pay the due amount including late fees but also it impacts credit score for both individuals. As your financial behaviour impacts your cosigner's credit score it is extremely important to understand how it impacts your relationship with the cosigner before considering asking someone to be a cosigner on your application.

iii) Open your first credit card account

If you already have a decent credit history established, apply for a no annual fee credit card with a smaller credit limit. Choose a card that has higher approval odds for your credit score. Once you have the credit card follow the best practices to build a good score.

Once you choose which is an appropriate way to apply for your first credit card then follow these below steps to build a good credit score.

Set-up Auto payment

Missing credit card bills has a huge impact on your credit score. Easy ways to pay credit card bills are set up auto payment so you never miss any payment, no need to worry about a late fee.

Keep the credit utilization below 30%

Don’t utilize the entire credit limit, it is not only difficult to repay the entire amount if you do not liquid cash you may incur unwanted interest. High credit utilization is also bad for your credit score so the recommendation is don’t go more than 30%.

Treat it like your own cash

Though you can feel like you are getting interest free money for 45 to 50 days you need to consider your repaying ability. Just because you can get rewards, cashbacks don't overuse your credit cards hoping to maximize the benefits. Because if you fail to manage your money and fail to repay your bills it can backfire and incur unwanted financial damage.

Request a credit limit increase

Increased credit limit not only benefits to build a good credit score but also helps you to have a higher credit amount available for your spending and maintain a lower utilization. If you follow the best practices while using a credit card your score will automatically increase. Most issuers automatically increase your credit limit once in 6 months but if it’s not increased for you then you can request an increase by just calling the customer care centre or requesting online. Usually, issuers only do a soft pull while increasing the credit limit, so make sure you ask them and confirm before requesting for an increase.

FINANCIAL BEHAVIORS AND MISTAKES TO AVOID

Financial behaviours can help you build an excellent credit score or drag your score down. It is important to know what are the good behaviours and avoid mistakes that impact your credit score.Not understanding how much you can afford

You need to maintain a lower outstanding debt compared to your income. Lenders do calculate your DTI ratio while approving your applications. Debt-to-income (DTI) is a ration on how much you owe to how much you earn each month (debt/income). Specifically, it’s the percentage of your gross monthly income (before taxes) that goes towards payments for rent or mortgage, credit cards, or other debt. In general, DTI less than 36% is considered as a good financial habit. You need to keep an eye on your DTI and if your DTI increases it means it is going to be difficult to pay your monthly payments. So keep DTI under control.Not having a budget

Technology is making it easier to shop online, so more than ever, it is very important now to create a budget. The key factor to manage money more efficiently is to create a budget and adhere to the budget. Having a budget helps you to know how much you are saving and how much you are spending and helps you to make better financial decisions. For example, you can clear your debts by using savings from following a strict budget.Inspect your bills regularly

You should keep a habit of inspecting your bills regularly to identify unwanted expenses, discrepancies and react immediately to any fraudulent transactions. One best practice is you take 3 month bills once a quarter and sort all your expenses and bucketize them. Sorting through all your expenses can help you not only identify unnecessary expenses but also help you to create budgets.Failing to shop around for the right card

In general, most people won’t shop around and compare the deals when they are choosing a credit card or applying to a loan. They just follow friend recommendations. It won’t work all the time because everyone's spending habits are different so you should do a comparison for the best possible credit card or loan. If you spend time comparing all the available deals you will find the best credit card with maximum benefits and a lower annual fee.Frequently asked questions

What does no annual fee mean?

Can you get a no annual fee card if you have bad or no credit?

What kinds of no annual fee cards can you get?

Are annual fees ever worth it?

What's the best credit card with no annual fee?