Why you should use credit cards?

TL;DR If you are a financially disciplined person then take these advantages by using credit cards.

- Build positive and high credit score

- Earn while you spend in terms of rewards

- Take a "free" one month loan

- Protection against fraudulent usage

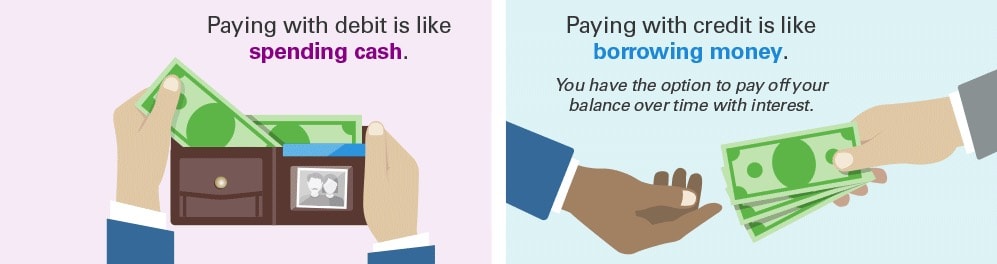

In this internet age, plastic money (both credit cards and debit cards) makes it such a convenient to shop over using cash, so it is no brainer to use cards over cash. But you may have a question which card to use and why? So I have provided my opinion in this post why one should use one or the other. If you are here to find out why use credit card or debit card, I assume you already know what and how they work.

Let me explain the advantages of using Credit Cards.

Build possitive and high credit score

First what is a credit score? According to wikipedia, a credit score is a numerical expression based on a level analysis of a person's credit files, to represent the creditworthiness of an individual. So credit information companies like CIBIL provides each individual a numeric score within a range, this numeric score represents your credit score. These companies source credit usage and payment history of the individuals on credit cards, loans etc and apply an algorithm to determine the score.

Why is it important to build a high credit score? Higher score means higher chances of loan approvals in case if you plan a car or a home loan.

Earn while you spend

There is so much you are missing out if you are not using credit cards in terms of cashback, instant discounts and deals. If you want to know what you are missing take a look at our Top Credit Cards page.

"Free" loan for one month

As you all know credit cards are a means of approved credit lines subject to a limit. Though this limit is based on individuals everyone has a certain limit that they can use beyond their monthly income. So if you are good at managing your cash flow then take advantage of upto one month interest free loan.

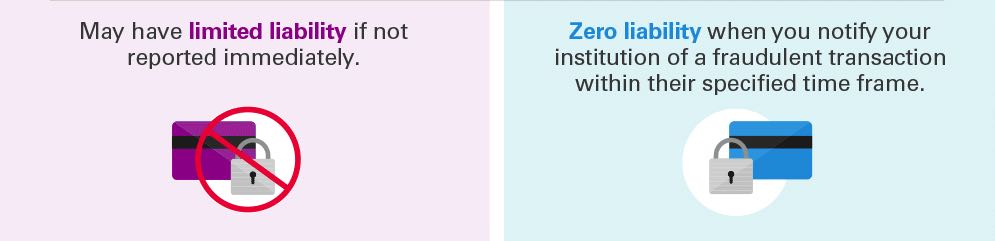

Protection against fraudulent usage

Many banks offer credit card protection plans for a minimal fee. When you purchase these plans then you are protected against any fraudulent usage of your credit card that is lost, stolen or hacked and also these plans offer emergency hotel and travel assistance if you lost the card while you are still travelling.

Hassle-free alternative to applying a loan

If you are about to apply for a personal loan and planning a big purchases then think about buying it on a card and converting into an EMI. These days most of the banks do provide an easy way of converting a transaction into an EMI. This is a much better option than the hassle you have to go through the process of applying for a personal loan.