It is the time to do the tax-saving investment this year, subscriber has to take a review and look for the best tax saving investment schemes. Users can go either for two options of tax saving investment options such as PPF, Sukanya smaridhi, etc. On the other hand, some look for the ELSS saving schemes, as it is said that the ELLS savings funds give good and long-term returns. But the most important thing to invest in ELSS is to spot the right ELSS savings scheme that will give you a good return. Many subscribers check the previous annual return report of the banker and try to invest but that is not the right way, you cannot expect to form the previous year's performance. According to the previous researchers, no such fund has been stood best continuously for 5 years in the market to give away the best annual return. It would give the subscriber a fruitful return if the investor looks for the fund schemes which is consistently doing well in the market. According to the research, there are 10 such great ELSS Funds available in the market who had been performing consistently well.

Key Points

- It is the right time to plan to invest in the best tax-saving scheme.

- As we have many investment options many choose ELSS funds as they give maximum annual returns, up to 10% maximum depending upon the market performance.

- To get a better ELSS annual return check for the funds that are the consistent performance of the funds.

There are 3 types of funds like Hot Funds, Ahead of the Curve, and Defensive Funds. The below picture will explain to you the performance of these funds.

From the above survey, one can expect the best ELSS funds, presently the most favorite ELSS fund is:

Canara Robeco Equity Tax Saver Fund

If the subscriber invests 1 lakh for 1 year the return will be 1.14 lakh and for 2 years the return would be 1.31 lakh, for 5 years the return would be 1.62 lakhs, and for 5 years the return would be 2.69 lakhs.The below image clearly shows how this shows consistent performance.

SIP returns of the Canara Robeco Equity Tax Saver Fund

The Canara Robeco Equity Tax Saver Fund has started in 1993 March. It has been performing best for the past 10 years and still performing well in the market and the annual fund returns were always promising. The Total Assets Under Management (AUM) is RS 1212 crores, Expense Ration 2.26%, Turnover 160%.

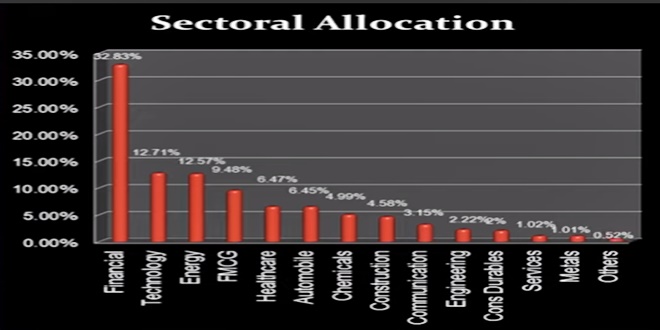

Sectoral allocation of the Canara Robeco Equity Tax Saver Fund

Mirae Asset Tax Saver Fund

It is another best scheme as it has shown its potential performance we can expect good returns in the coming days. This Fund was started in the year 2015 December. It invests mostly in the top 200 shares. And it is consistently top funds for 4 years and the Total AUM is Rs 4270 crores, expense ratio is of 1.77% and turnover is 88%.

SIP Returns of Mirae Asset Tax Saver Fund

Sectorial Allocation of Mirae Asset Tax Saver Fund

Invesco India Tax Plan

This fund is another best tax saver fund, the annual return for 10 years were highly potential in the performance.This fund was established in the year 2006 December, it has been investing in the top 20 shares and it has been giving promising annual returns up to 13.03%. It has been showing potential performance for 10 years. The total AUM is Rs 1,134 crores, the Expense ratio is 2.33% and the turnover is 99%.

SIP of Invesco India Tax Plan

Sectoral Allocation of Invesco India Tax Plan

Bottom Line

According to the research, the above three tax-saving scheme are expected to give promising returns in 2021, to get the best returns, do a little survey about the tax-saving funds look on at their consistent performance, and go ahead to invest your money and enjoy the tax-free benefits.