Everyone's dream is to be financially settled and stable. But the real question is - Is it hard to achieve a good financial state? My answer is no if you follow healthy financial habits and take necessary steps you can achieve required financial stability that you dream of. People think achieving financial stability means becoming rich but it really means having good financial discipline.

Follow our simple score calculator to understand your financial state. Answer these questions and add points to find your financial health score.

1) Do you know your net worth?

You need to understand your financial status and many people think it’s a difficult job to calculate the net worth but it is very simple if you know your total income and total debts. To reach your short term and long term financial goals. It’s very important to know your current net worth, that is what you own and what is your debt.

Net worth = Assets (what you own) - Liabilities (what you owe)

Assets: cash, liquid assets (you could sell for cash). Liabilities: credit card debts, personal loans

It is a good practice that you keep a track of your net worth yearly. If you have a good net worth then you get 100 points otherwise 70.

2) Do you have a 50-30-20 budget?

Are you tracking your income and expenses? If not this is not good practice. An easy way to create a budget is to follow the 50-30-20 rule. In your income allocate 50% for your needs, 30% for your wants and save 20%. Needs are essential for you to live and work like food, housing and basic utilities like power, mobile, internet and dish, transportation and insurance. Wants are things that are not mandatory for a living but make your life comfortable and so many people consider wants as luxuries such as dining out, gifts, travel and entertainment. It all depends on what you want in your life and what you are willing to sacrifice. Savings are essential for your long term goals such as owning a house, kids schooling and retirement. You can save your income into stocks, bonds, PF, rental properties and retirement fund.

If you don't have any budget you need to follow these 4 simple steps

- Analyze Spending - You need first analyse your spendings and an easy way is to take your 3 to 6 months credit card bills and create a list of your spendings and distribute them into different buckets.

- Create a budget - Using our 50-30-20 rules look at your list of expenses and categorize your spendings into needs, wants. Set a limit on your needs and wants to 50% and 30%.

- Cut your expenses - You need to reduce any excess spendings on top of 50% needs or 30% wants. Either cut unwanted spendings or reduce the amount of spending.

- Communicate to the family - Once you create your budget communicate your budget and your plan to your family and set an expectation.

- Strict to the budget - Following a budget is more important than creating it. Once you start following your new budget keep a habit of revisiting your spending habits once in a quarter to adjust your budget.

Is the 50/30/20 rule good?

50/30/20 rule is just a starting point to have a good financial habit. You don’t have to take this rule literally, you can adapt the percentages based on your profile like you can reduce wants to 20% and increase savings to 30%. You need to repeat yourself the process the understanding what percentages works for you and find the perfect balance in your budget

If you have a budget you scored 100 or else 70.

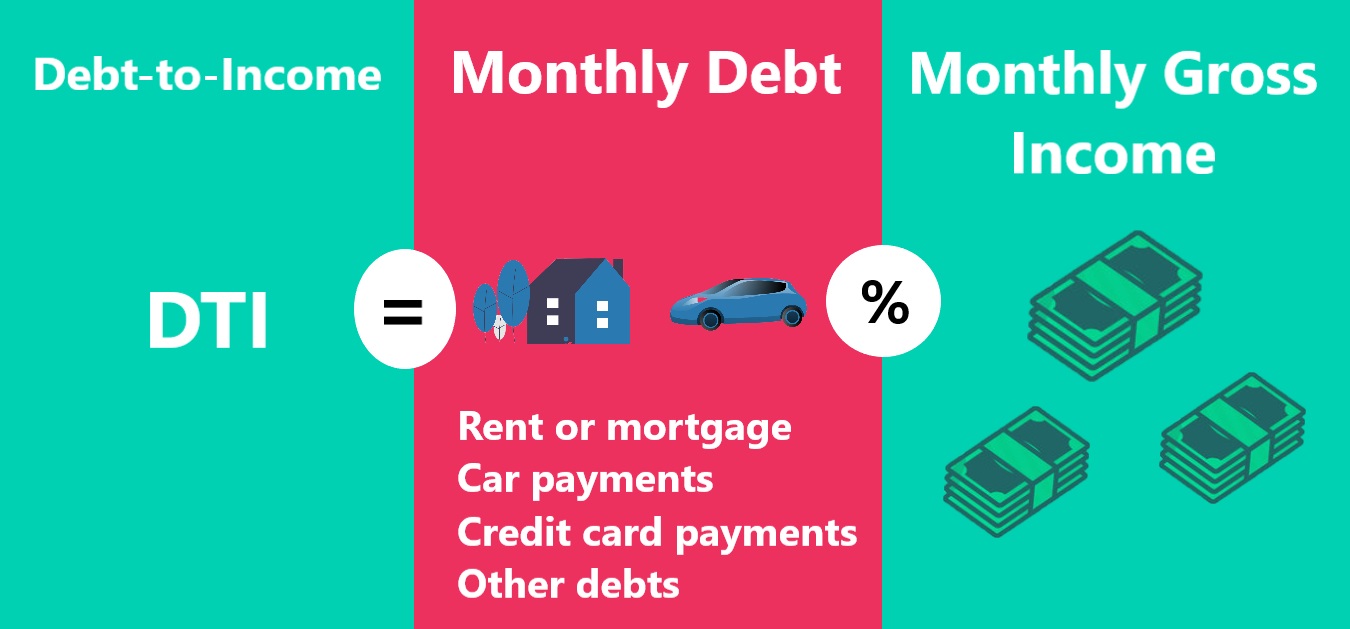

3) Do you have any debts? Is your DTI score less than 36%?

If you have any debts it’s ok, leveraging credit is not bad, debt is not a problem until your payments are manageable and lower than your excess money (that is monthly income - needs). Debt-to-income (DTI) is a ration on how much you owe to how much you earn each month (debt/income).

4) Do you make late payments? Are you ever late with payments?

If you didn’t miss any payments in the last 3 years, you get 100 points, if you missed 1 you get 90 points but you missed 2 payments and are not continuous then you get 80 points if you miss more than two you get 70 points.

5) Do you have an emergency fund to survive for 6 months without a paycheck or income?

An emergency fund is a personal savings set aside by following a strict budget on your expenses to provide a financial safety net during difficult times or when the unexpected expenses. For example job loss, medical emergency.

100 points if you have at least 6 month expenses as savings 90 points if you have 3 to 5 months 80 points if you have 1 to 3 months 70 points if you have less than a month

6) Do you know your credit score?

Credit score is a three-digit number that is assigned by credit bureaus based on factors that define your credit profile. In the modern economy Credit Score rules, to get a credit card, personal loan, mortgage, even some company’s check your credit history before they offer a job in the form of a background check.

100 points for a credit score higher than 800 90 points for a score between 750 and 800 80 points for a score of 650 and 749 70 points if you have less than a 649

7) Do you have a retirement fund?

The world is changing. We need to follow the trend, after retirement nobody wants to financially depend on somebody. As you already know how money multiplies over the period it is really important to start saving towards your retirement as early as possible and it does not matter how much.

How to calculate a retirement fund?

Nobody can predict the future but we can calculate what will be your future expenses based on current and past trends. When you are predicting future expenses, consider the inflation rate and medical expenses. For example, if you will retire in 15 years and assuming you own house and car, after considering all the factors(where to retire, inflation rate, medical expenses, first five years expenses will be more after retirement because travel the world and some other factor) the yearly expenses are ₹20 lakhs, so you need ₹20 Lakhs * 20 = ₹4 core retirement fund (the multiplier 20 is not a magic number. Considering you invested your retirement fund to give a 5% ROI each year, drawing 5% towards your expenses would be compensated with a 5% earning in every year, so you won’t run out of money during your lifetime).

Financial advisor William Bengen strictly tells you that you should be able to withdraw 4% of your retirement savings each year without running out of money during your lifetime. Considering 4% rate of return on your retirement fund then you need ₹20 Lakhs * 25 = ₹5 core as a retirement fund.

If you are saving 10%of your income for retirement, you get 100 points, 90 if you save 7%, 80 if you save 5%, and 70 if you save less than 5%.

8) Do you have any investments for the future?

Investing is a religion, If you don’t have much savings to invest you can start with a small amount and keep investing as simple as possible. Based on your risk profile you can invest in stocks, bonds, rental properties, gold or diamonds. If you have systematic investment plans then you scored 100 otherwise 70 points.

9) Do you have any financial goals?

You need to have financial goals that are time bound and you need to save money to achieve your goals. Financial goals are for example I want to save 20% of my income this year or I want to pay off ₹5,00,000 of debt this year or I want to save money for a house down payment in 2 years etc. If you have any time bound financial goals then you scored 100 otherwise 70 points.

Now add up your points and divide by 9.

If your score is greater than 90 you are an overachiever and your financial habits are awesome and you’re in a financially better position.

If your overall score is 80 to 90 then you’re in a very good spot and you should concentrate on your weaknesses and aim to achieve financial stability in the near future.

If your score is below 80 then you are in a bad financial state and you should act immediately to improve it. Don't be frustrated knowing your financial state is a wakeup call and you can start taking smaller steps to get rid of your debt and boost your savings and start improving your financial pulse.